Montgomery Village News Articles

MVF 2026 Draft Budget approved for publication

During the Aug. 28 Montgomery Village Foundation (MVF) Board of Directors meeting, the Board approved publication of the 2026 MVF Draft Budget. A 30-day comment period is now open for questions and comments on the draft budget.

President’s Remarks

MVF Board President Doniele Ayres began the meeting by thanking MVF CFO Daniel Salazar for presenting the 2026 Draft Budget and noting the work staff had done to prepare the draft budget.

Budget Presentation

Salazar began the presentation with an overview of Operating Funds (MVF/User Fee [UF] and Designated User [DU]), explaining where the monies for each fund came from as well as what each fund supported. He noted categories for Revenues, Operating Expenses and Other Income/Expenses in each fund.

He gave a high-level overview of the MVF Fund, explaining that given the proposed budget’s fluctuation in Revenue, Personnel, Operating, Other Income/Expense and use of Undesignated Reserves, there is a proposed increase in the MVF Fund of $0.77 per unit per month for 2026. This increase will be re-evaluated this fall when MVF receives more actual results through September.

Salazar expected a $14,688 increase in MVF/UF Fund Revenue, including Assessment and Service Fees ($108,288), Camps and Classes ($55,000), Capital Contribution Fees (CCF, $134,400), Investment Income ($16,500) and other Nominal Income ($2,300). Operating Expenses also increased $14,690 as follows: Personnel ($110,670, including a 3.5% salary increase for full-time staff; Business Expenses ($20,595); Insurance ($15,100); Finance and Legal ($19,376); Landscape Maintenance ($27,435); Contributions to Reserves ($10,807) and Other Income/Expenses (down $189,295, predominantly adjusting for lower CCF Revenues).

Salazar noted the DU Fund included a proposed increase of $1.25 per unit per month to cover a 3% increase in Personnel Costs ($48,697); a 5% increase in Operating Costs ($106,974); and a 10% increase in Other Income/Expense ($146,235).

The budget projects an increase of $151,611 of Revenue in the DU Fund including: Assessment Revenue ($135,236, attributed to the proposed increase) and Pool Memberships/Fees ($32,875); and a decrease in Other Revenue ($16,500). DU Expenses include Personnel ($48,697 due to the proposed 3.5% increase for full-time employees, and temp wages/minimum wage increases); Landscape Maintenance ($34,943); Occupancy ($17,790); Insurance ($11,066); Other Income/Expense ($43,174); Contribution to Reserves ($146,235); and increase in revenue from the use of Undesignated Reserves ($150,295).

Salazar reviewed the Undesignated Reserves Summary, noting the projected use in 2026 includes $343,757 to minimize the MVF assessment increase, $12,760 to subsidize UF programs, and $150,295 to minimize the DU assessment increase.

Salazar reported that MVF has $1,250,000 in State Grants for Capital projects, which is allocated to South Valley Park improvements.

The 2026 Contributions to Reserves total $1,961,993, with $311,003 toward the MVF Fund, $42,409 toward CCF, and $1,608,581 to the DU Fund. The Study assumes a 3.5% ROI and a variable inflation rate of $2.75%.

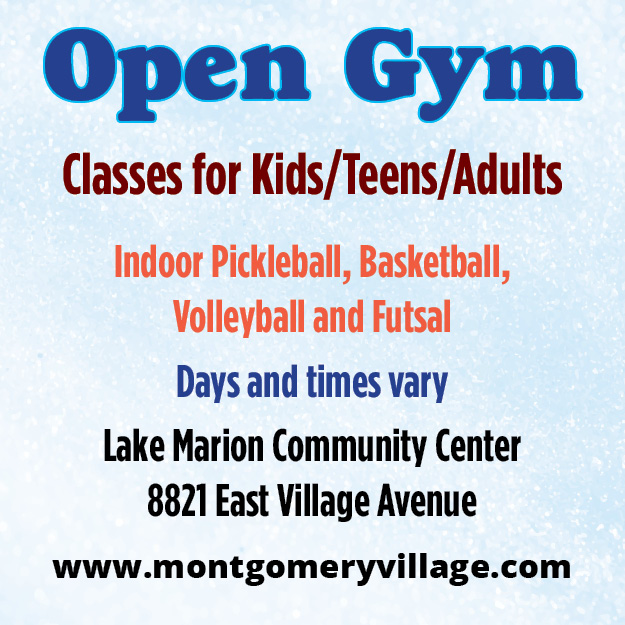

He noted that total Reserve Expenditures for 2026 totals $5,608,818, with $1,555,342 from MVF and $4,053,477 from DU. He shared that Reserve Expenditures from both funds is a combination of Necessary ($3,636,799) and Potential ($1,972,020) categories. Major MVF replacements include dredging and stabilization of the pond at South Valley Park ($351,882); IT hardware and software upgrades ($268,414); Pickleball and soccer court repair/resurfacing ($125,000); and wood decking of the Lake Whetstone dock ($116,654). Major DU replacements include: the remaining portion of the Stedwick Pool renovation ($2,775,616); asphalt and concrete work at various community center parking lots and walkways ($160,415); and Lake Marion Community Center heating and cooling replacement ($124,524).

Salazar reviewed the 5-Year Plan, noting new units in Bloom Village and at the Village Center are expected to be completed in 2027 and 2030, respectively. He noted the MVF Fund 5-Year Plan currently projects moderate increases each year, reaching the assessment ceiling in 2028. Salazar added that the DU Fund 5-Year Plan also projects moderate increases through 2030 to maintain the projected increases in expenses, temp labor, and CTR.

Resident Comments

The MVF 2026 Proposed Budget and budget presentation can be viewed in their entirety and are available for download here.

For the next 30 days, comments or questions can be directed to CFO Daniel Salazar via email at

Other Agenda Items

Salazar reported that following the recruitment process, which included reviewing applications and conducting an interview during a closed session meeting of the MVF Board of Directors in July, Dr. Jayaraman Vijayakumar was selected by the MVF Board of Directors for this position. The Board formally appointed Dr. Vijayakumar as the Board Treasurer.

EVP Mike Conroy reported that in mid-2024, staff were tasked with restructuring the landscaping contract to incorporate changes in service and updates to the community, and to explore all options in the marketplace. Subsequently, a small staff team was developed to prepare a Request for Proposal (RFP) identifying the current scope of services. After receiving and analyzing bids through a data-driven process, combining pricing comparisons, conducting formal interviews, and reviewing operational history and property-level insight, staff recommended moving forward with a new provider, Shorb Landscaping.

He said that recommending Shorb Landscaping reflects a strategic decision: they have a local presence serving eight Village HOAs; a dedicated staffing plan; a structured communication approach; and a long-standing and solid history of excellent service for contracts of similar size and scope. Conroy also noted the recommendation would maintain assessment stability (cost) and improve service delivery standards. The Board authorized the EVP to negotiate and execute a 5-year contract with Shorb Landscaping for landscaping and snow removal services to commence January 1, 2026.

EVP Report

Conroy reminded the Board that when new businesses come into the Village, MVF and the Board have an opportunity to work with the developers and the community and identify good partners, but do not control any final decisions that are made. He noted there are always opportunities for residents and the Board to engage and submit feedback, and as those come up, he will make sure the information is communicated to the public.

He also updated the Board about the roadwork project on Montgomery Village Avenue, noting concrete work continues, but the paving has been delayed until Spring 2026. He has asked the county if there are ways to reduce the delay, however the delay allows time for the pedestrian hybrid beacon infrastructure to be installed before the final paving is done.

Conroy also noted the “No Turn on Red” signs being installed at several intersections were a result of a county law that went into effect a couple of years ago classifying that certain intersections need or require the signs. He said he believes this action may have been triggered by all of the other intersection work being done at this time. Conroy also noted that the light and crosswalk signal timing at some of these intersections has been adjusted to allow more time for pedestrians. He said that all of these topics will be work for the Transportation, Development, and Public Facilities (TD&PF) Committee to be involved with, and he looks forward to that committee beginning its work.

Conroy also reported that MVF will cohost a Public Safety Town Hall with Councilmember Luedtke, 6th District Police Commander Brian Dillman and Montgomery County Fire and Rescue at 7 p.m. on Monday, Oct. 13, at 7 p.m. at North Creek Community Center.

Conroy said the permitting review process for the South Valley Park project was approved by both the state and the county, which allows staff to begin the RFP process for the work. MVF hopes to keep the costs below the $1.2 million bond in order to apply any leftover monies to upgrade the playground at South Valley Park. When the project is complete, MVF can turn structural maintenance of the facility over to the county.

He reported that Stedwick Pool was closed for the season and renovation of that facility will now begin. Staff will continue to provide updates to the Board over the coming months and look forward to opening the new facility next summer with a ribbon cutting ceremony.

Conroy closed by saying that Student Representative Hillary Juarez-Mendes completed her summer internship in the MVF Office. He commended her dedication and work with each department, noting it was a pleasure having her work with staff this summer.

Treasurer’s Report

Salazar presented the Treasurer’s Report for the year-to-date (YTD) and month ending July 31, 2025, noting that overall, all MVF funds were ahead of budget projections by approximately $1 million, driven by higher Revenues in Investments ($468,000), Camps and Classes ($80,000), Grant Revenues ($240,000) and Pool Membership/Rentals ($69,000), as well as lower Operating Costs by about $164,000.

He noted total Revenues were $7,148,808 and Operating Expenses were $5,553,218 through July; both were favorable to the budget.

Salazar said Capital Contribution Fees were $181,589 versus $220,208 budgeted for 2025. He accounted for this difference due to Bloom Village being behind schedule by about 30 units YTD according to Monument Realty. He added that Monument Realty still expects to finish out the year on schedule, and MVF will monitor the progress accordingly.

He said the Balance Sheet continues to reflect MVF’s strong financial position having $14.6 million of its $32.5 million assets (45%) held in Cash and Investments. MVF continues to hold $3.5 million in Undesignated Reserves. Assessment Receivables maintains a decrease of 12.4% or $81,000 over the previous year. The Delinquency Rate for July was reported at 19.5% (1,657 units), which is 0.7% higher than the 10-year average for the month of July (18.9%), but slightly lower than the previous year, which was 20.0% (1,697 units).

Next Meeting

The next MVF Board of Directors meeting is scheduled for 7:30 p.m. on Thursday, Sept. 25, as a conference call/Zoom meeting. Residents are invited to join the call; full meeting details, the meeting packet and/or participation instructions will be posted online at www.montgomeryvillage.com the week before the meeting.